2022 tax brackets

Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals filing separate returns and estates and trusts. Get help understanding 2022 tax rates and stay informed of tax changes that may affect you.

2022 Federal Payroll Tax Rates Abacus Payroll

These are the 2021 brackets.

. Typically the increase is small but this time using the big price jumps logged. Federal Income Tax Brackets 2022. Here are the new brackets for 2022 depending on your income and filing status.

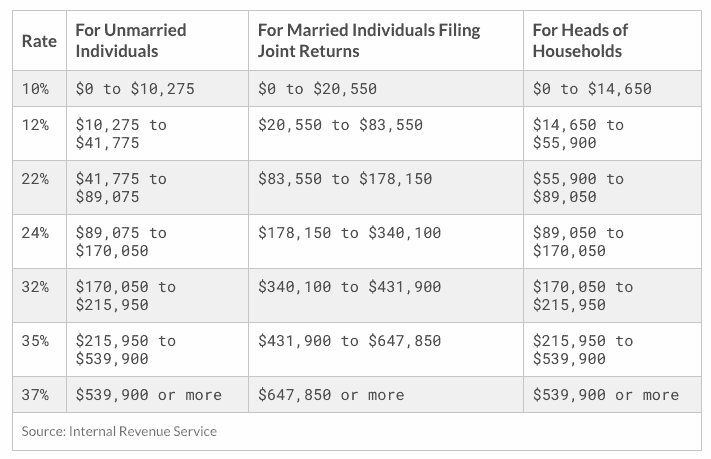

For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly. Only the money you earn within a particular bracket is subject to the corresponding tax rate. The 2022 tax brackets affect the taxes that will be filed in 2023.

Taxable income R Rates of. On this page you will see Individuals tax table as well as the Tax Rebates and Tax Thresholds scroll down. The 2022 tax brackets have been changed since 2021 to adjust for inflationIts important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the higher rate.

Married Individuals Filing Joint Returns Surviving Spouses. You can also see the rates and bands without the Personal Allowance. The lowest rate is 10 for incomes of single individuals with incomes of 10275 or less.

You do not get a Personal Allowance on taxable. Download the free 2022 tax bracket pdf. 10 of taxable income.

The IRS adjusts tax brackets annually using an adjusted version of the US governments Consumer Price Index. The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up to 20550. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation.

2023 tax year 1 March 2022 28 February 2023 23 February 2022 See the changes from the previous year. The tables below help demonstrate this concept. 12 for incomes over 10275 20550 for married couples filing jointly.

2022 tax brackets are here.

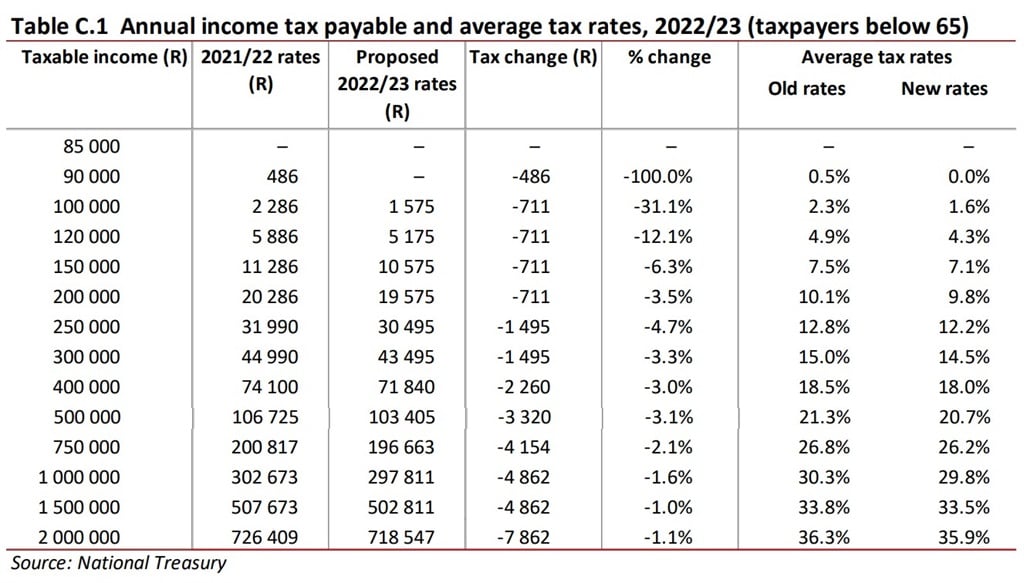

Budget 2022 Tax Relief These Are All The Big Changes Fin24

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

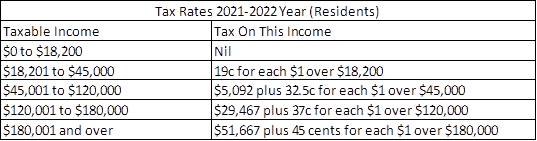

Australian Income Tax Brackets And Rates 2021 22 And 2022 23

Inflation Pushes Income Tax Brackets Higher For 2022

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

What Is The Difference Between The Statutory And Effective Tax Rate

2021 2022 Tax Brackets And Federal Income Tax Rates

Tax Brackets For 2021 2022 Federal Income Tax Rates

Hmrc Tax Rates And Allowances For 2022 23 Simmons Simmons

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Irs Announces Inflation Adjustments To 2022 Tax Brackets Foundation National Taxpayers Union

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Taxtips Ca Canada S 2021 2022 Federal Personal Income Tax Rates

2022 Trucker Per Diem Rates Tax Brackets Per Diem Plus

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

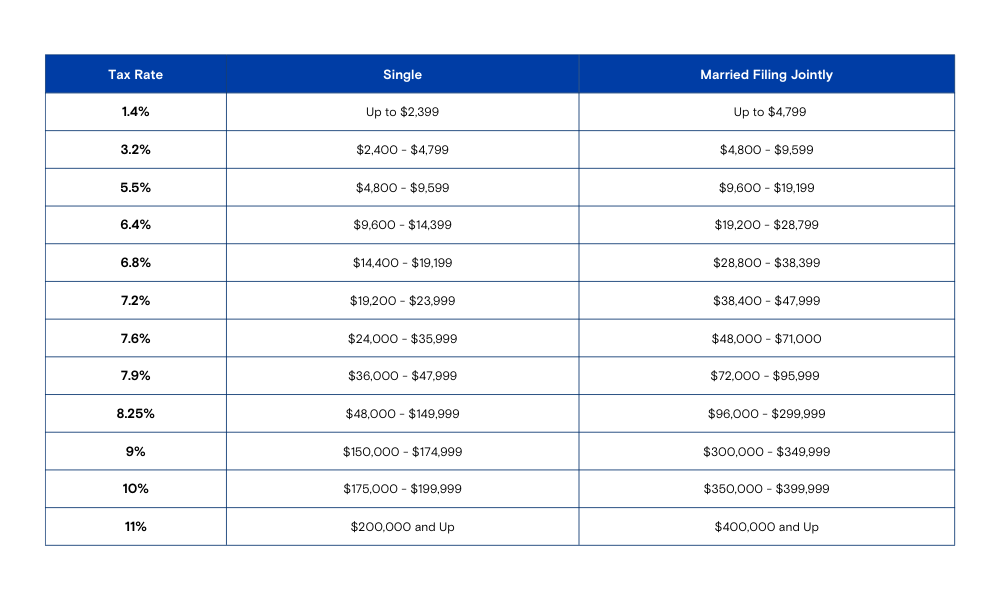

What S The Racket About Tax Brackets A Look At How Tax Brackets Work Bank Of Hawaii

Tax Rate Changes Starting Now Initiative Chartered Accountants Financial Advisers