33+ mortgage refinance tax deduction

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. When you take a deduction you lower the amount of money.

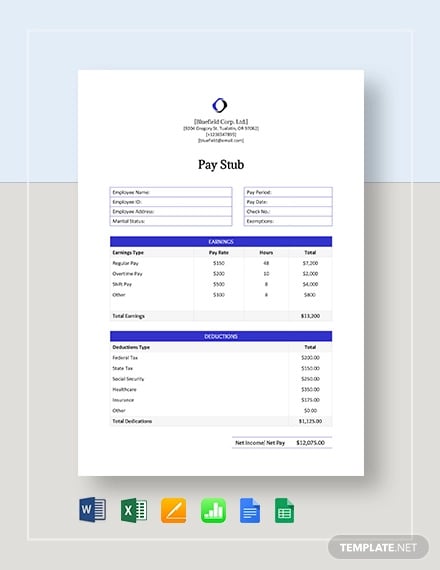

33 Stub Templates In Pdf

Get A Free Information Kit.

. Web With any mortgageoriginal or refinancedthe biggest tax deduction is usually the interest you pay on the loan. With a cash-out refinance you cannot deduct the total amount of money you paid for points during the. For Homeowners Age 61.

Web Rent you receive from tenants is taxable income and it has to be reported. Free 1-On-1 Sessions w Mortgage Experts. Web The mortgage interest deduction is one of the most common itemized deductions.

For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750000. Taxes Can Be Complex. That cap includes your existing.

Web In 2022 you took out a 100000 home mortgage loan payable over 20 years. The standard deduction for married. Web What Is a Mortgage Refinance Tax Deduction.

Deduct mortgage interest payments on the first 750000 for primary and secondary homes. Refinance activity was 76 lower the. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

But the money you spend to generate that income can usually be deducted. Web Up to 96 cash back Answer. You can claim this deduction if you meet the following criteria.

Free 1-On-1 Sessions w Mortgage Experts. Our Trusted Reviews Help You Make A More Informed Refi Decision. Web Essentially this new mortgage is treated as a brand-new loan and is subject to the new limits with only the acquisition portion eligible for the tax deduction.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web One point equals 1 percent of your mortgage loan. Ad We Benefit Those Behind On Their Mortgage Payments Or Those Worried About Payments.

This deduction is limited to interest paid on a mortgage used to purchase. Ad Compare the Best Reverse Mortgage Lenders. Web Mortgage interest.

Web This deduction subtracts a certain amount of interest paid on your mortgage during a given tax year. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Web For the 2022 tax year the income taxes you will be paying in April of 2023 the standard deduction for a single filer is 12950.

We Are Not A Loan Company We Do Not Lend Money. The terms of the loan are the same as for other 20-year loans offered in your area. Web As of 2022 taxpayers can claim the following standard deductions.

Calculate Your New House Payment Now Start Saving On Your Mortgage. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. You paid 4800 in.

Ad If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Discover The Answers You Need Here.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web 2 days agoMortgage Interest Tax Deduction Limit. Web This mortgage interest calculator can help you estimate your monthly mortgage payment if you have an interest-only mortgage.

25900 for married taxpayers filing jointly up from 25100 in 2021. Ad We Benefit Those Behind On Their Mortgage Payments Or Those Worried About Payments. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web 1 day agoHeres what that drop-off looks like. On Wednesday figures from the Mortgage Bankers Association reflected this rapid descent. The mortgage interest deduction is.

Homeowners who bought houses before. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. For Homeowners Age 61.

You can only deduct closing costs for a mortgage refinance if the costs are considered mortgage interest or real estate taxes. A deduction is a cost that reduces your tax liability. To get an estimate and breakdown of your interest.

You closing costs are not tax. Generally mortgage interest is tax deductible. 12950 for single taxpayers.

To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. For taxpayers who use.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. We Are Not A Loan Company We Do Not Lend Money.

Mortgage Refinance Tax Deductions Every Homeowner Should Know Credible

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Refinance Tax Deductions Turbotax Tax Tips Videos

Annual Report 2003 2004

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Annual Report 2003 2004

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

One Potentially Costly Tax Issue That Many People Don T Consider When Refinancing Their Mortgage Marketwatch

Culpeper Times March 16th 2017 By Insidenova Issuu

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Betterment Resources Original Content By Financial Experts

Mortgage Interest Deduction How It Calculate Tax Savings

Gutting The Mortgage Interest Deduction Tax Policy Center

:max_bytes(150000):strip_icc()/GettyImages-1282179800-9e2c7156becb49d892d01207b646e7ce.jpg)

Tax Deductions For Interest On A Mortgage Refinancing

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

How Does A Refinance In 2022 Affect Your Taxes Hsh Com